If you had an injury at work, the processes associated with making a claim for your injury can be extremely confusing and demanding. The actions included can be complicated, from filing a claim to following up with the insurance company. What am I entitled to if I have a work injury? How am I expected to earn money? Can I choose own doctor? Being off work and not having money coming in makes things even harder and more demanding.

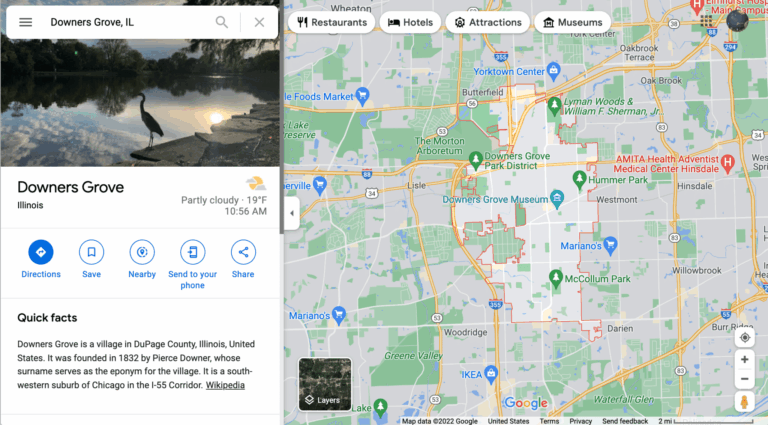

Work injury victims in Downers Grove, IL can rely on The Law Office of Scott D. DeSalvo, LLC, where we are dedicated to assisting hurt workers in Downers Grove, IL with work injury claims. We devote our entire law practice to helping victims of injury.

We do everything we can for you, from filing the case, to talking to the insurance adjuster, to making sure your medical care is working for you, to settling your case for optimum value. Call us for a free no commitment assessment so you can get responses to your concerns.

Practically all Illinois workers are entitled to Workers' Compensation benefits if they are hurt on the job. Benefits include necessary and sensible medical expenses, temporary replacement earnings, job retraining assistance, and compensation for long-term disability.

Nevertheless, because your employer's costs increase when you gather benefits, your employer might try to limit the quantity of medical care you receive. When they pay you as little as possible, which holds true even if your injuries are major, workers Comp insurance companies make revenue.

You are not in the strongest position to fight the system when you are dealing with the effects of a significant injury. A Downers Grove, IL Workers Comp attorney who is well-versed in the laws and ways of the Illinois Workers' Compensation system remains in a much better position to fight for your interests and guarantee that you receive the compensation owed to you.

At The Law Office of Scott D. DeSalvo, LLC, we understand the pain and financial difficulty that is experienced when an individual is seriously hurt and can not work. When you hire us to represent you in your Workers' Comp case in Downers Grove, IL or nearby areas, we will help to make sure that you get all the benefits allowed under the law. Our number one priority is helping you and making sure you recover from your injuries and getting you all of the benefits enabled under the law.

We give top notch legal representation to customers seeking compensation for on-the-job injuries in Downers Grove, IL through the Illinois Workers' Compensation Commission (previously known as the Illinois Industrial Commission). We likewise assist people in car crashes, fall downs, dog bites, nursing home abuse, or no matter how they got hurt.

We represent individuals who work in every kind of job. We assist people in education, retail workers, building and construction workers, truck drivers, cab and Uber drivers, and factory workers. We help anybody employed in Illinois if they got hurt at work.

Find Out What YOUR Case Might Be Worth...for free.

Just because an employer offers Workers' Compensation Insurance, it does not imply that you automatically get benefits. Workers Comp insurers want to delay and deny claims to save money. This gives them larger earnings. That's why I inform individuals who got hurt at work to talk with a skilled Workers Comp lawyer after any work injury.

There are lots of strategies an employer can use to attempt to eliminate a Workers Comp Case in Downers Grove, IL. If an employer attempts to deny a Workers' Compensation claim then the injured worker ought to speak with a lawyer right now. If there is no valid defense, then a lawyer can get your benefits and costs paid quickly. On your own, you will probably be at their mercy.

Often, an employee is "On the Clock" and gets harmed by another person. Examples include a delivery driver whose truck is hit by another driver, or a worker who is hurt by someone who is not employed by that very same company. In these situations, you would have a 2nd case. It is called a "Third Party Case" and you still get Workers Comp benefits. Keep in mind that you can also make a claim against the person and or company who injured you. This can get complicated, so having a Downers Grove, IL Workers Comp lawyer there to help you is a wise choice.

You ought to know that if you got hurt on the job in Downers Grove, IL, you are most likely covered under Workers Comp. To understand your workers' compensation rights, you must know that state laws manage your claim.

Injured workers in Downers Grove, IL are usually covered in Illinois. It is important to note that there are some scenarios where an employee is NOT eligible for workers' comp advantages, consisting of:

In many circumstances, benefits must be available in case of an injury. It is quite uncommon for an employee to not be qualified for Workers Comp benefits. The law also sets out the roles and obligations of an injured worker and the employer. These include the "45 Day Rule" which requires that injured worker to report their injuries within 45 days after its occurrence There are a great deal of these rules, so having a lawyer on your side is the right move.

You have 45 days to report the accident. You should tell your employer via a supervisor or member of the management group about the accident and or injury. Ideally, you do this right when it happens. In some cases, an employee does not wish to make a big deal about it, or they feel embarrassed. You MUST tell your employer. You could lose your case if you do not.

When you employ a Downers Grove, IL Workers Comp attorney, she or he will discuss what you need to do. Your lawyer will safeguard all the due dates and requirements so you can focus on getting better and recovering.

Practical expectations are important. Small injuries result in smaller settlements, normally. Bigger injuries mean more money. If you wait a long period of time prior to hiring a Workers Comp attorney in Downers Grove, IL, the insurance company might be currently harming your case behind the scenes. It can be some time before issues within a case are fixed. Great interaction and trust with your lawyer is key. Your lawyer ought to communicate with you. Your lawyer ought to offer to address your concerns. She or he ought to be able to inform you on roughly how long the case will take. A Workers Comp lawyer in Downers Grove, IL can tell you the strong and weak points of your case.

Your case will probably run simpler and smoother with a great lawyer. However in some cases, a case can simply take a great deal of time and have issues which restrict its value. This might disappoint you, but it is a fact.

A basic injury at work can start out feeling like a minor injury that you will easily recuperate from. How you heal in the weeks and months after the injury reveals just how bad your injuries are.

If you make a claim, you might be stressed about whether you will get into trouble at work. Or you might even question whether your injury is one that will be covered under Workers Comp.

Here are the most typical workplace injuries:

These are the most typical. However there's great deal of ways to get hurt at work in Downers Grove, IL.

Call us at The Law Office of Scott D. DeSalvo, LLC if you're searching for the very best Downers Grove, IL Workers Comp Lawyer. Workers Comp lawyer Scott DeSalvo is here to help you. He has the knowledge and experience required to win your case. What this means for you is a quicker settlement and the very best result possible for you. We can help get you the benefits you deserve in your case. We can ensure that you get paid, that your medical costs get paid, and that the whole process runs smoothly. Or as smooth as possible.

The assessment is complimentary. And we only make money AFTER we get you paid. We never request money out of your pocket. Give us a call night or day at 312-500-4500.

Would you like to know more about workers' comp lawyer chicago? Click Here

If you or a loved one is dealing with a situation like this, give us a call any time, day or night. We are here to help. 312-500-4500

Scott DeSalvo founded DeSalvo Law to help injured people throughout Chicago and surrounding suburbs. Licensed to practice law in Illinois since 1998, IARDC #6244452, Scott has represented over 3,000 clients in personal injury, workers compensation, and accident cases.

No Fee Unless You Win | Free Consultation | 24/7 Availability Call or Text: (312) 500-4500

>>Read More

Main Office:

1000 Jorie Blvd Ste 204

Oak Brook, IL 60523

New Cases: 312-500-4500

Office: 312-895-0545

Fax: 866-629-1817

service@desalvolaw.com

Chicago and Other Suburban Offices

By Appointment Only