When you get into a car accident, you have a lot to deal with. If the initial police report and information swap doesn’t stress you out, you often have to put up with medical treatments, and sometimes, you might even have to go to court.

However, there’s another source of stress that a lot of people don’t think they can do much about. The insurance company.

You will end up filing a claim with your insurance company, and what you’re likely to find is that they aren’t in a hurry to pay you what they owe.

Today, we’re going to help you handle the insurance company after a car accident to get your life back on track quickly.

Why are Insurance Companies Stressful After Car Accidents?

You’d think that filing your insurance claim would be the easiest part of getting into an accident. After all, sustaining injuries and going through recovery is life-changing, and potentially having a legal issue with the other party is supposed to be the real stressful situation.

However, insurance companies have a unique business model. They hedge their bet that you won’t need their service. You pay your payments regularly, and they simply hope you won’t be eligible for a payout before your policy is ended. That’s how they make all their profits.

As such, when you do make a claim, their business model doesn’t work out as planned. To prevent that, they look pick through your claim with a fine-tooth comb to find a way to give you minimal compensation or deny compensation entirely. Some insurance companies even use shady tactics such as stalling payouts until you’re no longer eligible.

How Do Insurance Delays and Denials Impact You After a Car Accident?

With everything going on, you might be tempted to accept delays or take your time fighting denials from the insurance company. However, not only is that what they are often counting on, but it also has a tremendous impact on your life that creates a lot of stress.

Your insurance payout can get your car fixed or replaced so you can reliably get to your medical treatments, participate in the litigation process if necessary, and start to return to your normal day-to-day life.

Even if you’re expecting a large win in court, cases can take a very long time, and you’ll be financially struggling while you wait. You might not even get what you’re looking for, at all.

This is why it’s crucial to put focus on dealing with a stubborn insurance company as soon as possible.

Steps to Handle the Insurance Company Properly

Whenever you’re in an accident, you don’t just file a claim and go about your day. There are steps you need to take to minimize the chance of setbacks.

1. Gather All Required Information

One of the easiest ways an insurance company can postpone giving you what you’re owed is to claim you haven’t met the information requirements. It doesn’t matter if it’s a small detail they could easily call and ask for over the phone, or a major detail that warrants postponing the process. They’ll pause the whole thing and make you go through as many hoops as possible to get things on the right track.

So, before you file, make sure you gather all the necessary information for the accident and for your personal documentation that’s required. This will help get rid of ways for the insurance company to cause problems.

2. File ASAP

You want to be prepared to file correctly, but you don’t want to take forever. The amount of time you have to file your claim will vary between policy providers and state laws, but you can easily get that information in your insurance documentation. Do not miss the deadline, and don’t wait until the deadline is approaching to file your claim.

Instead, file your claim as soon as you have gathered the necessary information and prepared yourself properly to deal with any unexpected issues that pop up.

3. Stay on the Phone

It will get annoying, but it’s important to stay in contact with your insurance provider to ensure the process is going along smoothly. If you’re not applying pressure, they’re not incentivized to hurry up and process your claim. In fact, they’re incentivized to put it off as long as possible.

Don’t harass the insurance company’s office or act inappropriately, but apply pressure and stay on top of the process.

Also read: Car Accident Question: What To Do When Insurance Will Not Pay?

4. Be Prepared to Get Another Opinion

This is the next hurdle you’re likely to face: A low-ball offer.

Again, the insurance company doesn’t profit from paying on claims. So, when they have to, they try to minimize the amount of money you’re actually entitled to. You’ll often get an offer that doesn’t even cover the damage done, and there’s no reason in your policy for that to happen.

When this happens, you might need help. There are a couple of ways to do this, but our next tip actually helps with all of these issues.

5. Don’t Make Your Claim on Your Own

Finally, don’t make your claim on your own. Insurance providers want to be the first person you call after an accident, because they can set you up for a lower payout or denial.

Instead, call a car accident lawyer.

Most people think that you only hire a lawyer when the law has to get involved and it’s a serious accident, but you should call your lawyer first even if you’re in an accident by yourself with no chance of legal action being required.

This is because lawyers bring the same skills they offer in the courtroom to the insurance claim process.

From the start, your lawyer can help you gather your information, make your claim, and then fight all of the issues we’ve mentioned in this guide. You can go from months of arguing with the insurance company to enjoying a smooth and speedy payout.

Call DeSalvo Law and Get the Insurance Payout You Deserve

Dealing with insurance companies after an accident can be overwhelming, especially when delays, low-ball offers, or denials arise. These challenges can slow your recovery, delay repairs, and cause unnecessary stress during an already difficult time. That’s why having the right guidance is crucial.

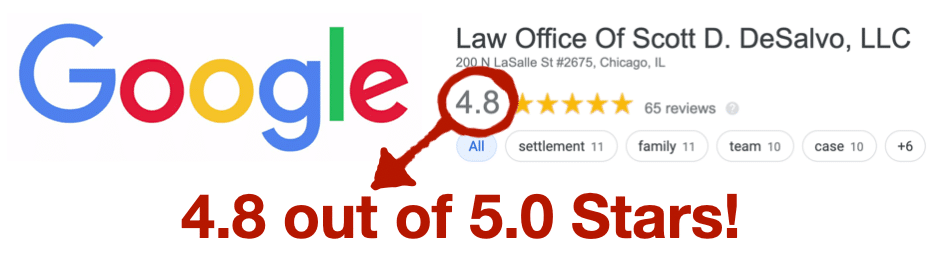

At The Law Office of Scott D. DeSalvo, we specialize in helping clients navigate the complexities of insurance claims, including personal injury cases and accident-related disputes. Whether it’s providing legal support for car accidents, motorcycle crashes, or other injury claims, our team is here to ensure you get the compensation you deserve.

Don’t let the insurance company dictate the terms of your recovery. Contact us today to take control of your insurance claim and get the support you need to move forward with confidence.